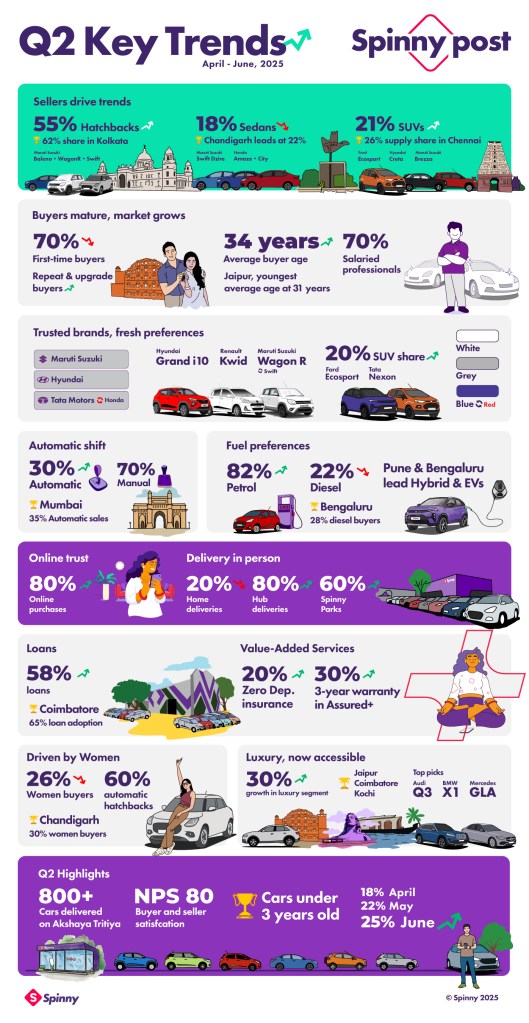

India’s used car market continues to evolve digitally, demographically, and geographically. Spinny, the country’s leading full-stack used car platform, has released its Q2 2025 Trend Report, offering a data-backed, consumer-first view of shifting buying behaviour across channels, formats, and regions.

Key Highlights Q2 2025

Automatic Cars – 30%

Home Deliveries – 20%

Hub Deliveries – 80%

Online Purchases – 80%

Women Buyers – 26%

Average Buyer Age – 34

Car Finance – 58%

First-Time Buyers – 70%

Petrol Preference – 82%

Sellers drive trends

Spinny’s Q2 data shows that hatchbacks made up the majority of seller supply at 55%, with Maruti Suzuki dominating the list of most-sold cars by sellers.

The WagonR, Baleno, and Swift were the most frequently sold models by sellers. In Kolkata, hatchbacks accounted for 62% of the city’s total vehicle supply.

SUVs accounted for 21% of the inventory, led by the Ecosport, Creta, and Brezza. Chennai recorded the highest SUV share, with 26% of vehicles supplied in the city falling under this segment.

Sedans made up 18% of total supply, with the Honda City, Honda Amaze, and Swift Dzire as the leading models. In Chandigarh, sedans comprised 22% of the city’s total vehicle supply.

Buyers mature with used car market growth

70% of Q2 buyers were first-time car owners, down from 74% in Q1, indicating rising repeat and upgrade buyers.

The average buyer age rose from 32 to 34 years, suggesting more thoughtful, value-driven decisions and a growing preference for used cars.

Trusted Brands, Fresh Preferences

● Maruti Suzuki and Hyundai retain the top two brand positions.

● Tata Motors moves ahead to third, replacing Honda, driven by new models and diverse fuel options.

● Top models include the Hyundai Grand i10, Renault Kwid, and Maruti WagonR, which overtook the Swift from Q1.

● White and Grey remain the most popular colours, while Blue has surpassed Red—signalling a shift toward bolder, trendier choices.

● SUVs continue to grow, holding a 20% share, led by the Ford EcoSport.

Fuel and transmission shifts

● Automatic cars accounted for 30% of Q2 sales, up from 29% in Q1, led by Mumbai with 35% automatic purchases.

● Petrol vehicles remain dominant at 82%, while Bengaluru had the highest share of diesel buyers at 28%.

● Pune and Bengaluru are showing growing interest in hybrids and EVs.

City-by-City landscape diversifies

Spinny’s data highlights unique regional trends:

● Bengaluru was the fastest-growing city overall, with diverse fuel preferences and strong demand

● Kochi led in home deliveries, with over 40% opting for doorstep handovers

● Chandigarh had the highest share of women buyers (30%+)

● Jaipur hosted the youngest buyers, with an average age of 31 years

● Delhi NCR, Bengaluru, and Hyderabad remained top markets by volume, while Pune continued its upward climb

Online Trust, Delivery in Person

80% of Spinny customers bought their cars online in Q2, up from 77% in Q1. This digital-first journey—powered by transparent pricing, verified vehicle histories, and doorstep convenience—has become the norm.

While home deliveries dipped slightly to 20%, hub-based pickups increased to 80%, with 60% of those occurring through Spinny Parks. This shows that while customers trust booking online, many still value the touch-and-feel experience that hubs provide. Spinny Parks offer a premium, new-car-like buying experience.

Loans and VAS at work

● Financing continues to surge, becoming the preferred mode of ownership for salaried customers.

● 58% of buyers opted for car loans in Q2, up from 57% in Q1

● 70% of Spinny’s buyers are salaried professionals

● Coimbatore topped the chart with over 65% loan adoption

● Assured+ Warranty attach rate grew to 30% till June, reflecting growing demand for post-sale assurance

Women buyers: A consistent growth story

Women buyers accounted for 26% in Q2, a slight dip from 28% in Q1, but part of a strong multi- year growth trend. Over the last three years, women’s share on the platform has more than doubled, driven by rising independence, 60% preferred automatic hatchbacks, and gender- inclusive financing options.

Chandigarh led with over 30% women buyers, the highest in India, with strong presence also in Delhi NCR, Hyderabad, and Bengaluru. Continued focus on women-centric services is expected to drive further adoption in H2.

Luxury, now accessible

● Luxury demand remains strong, driven by experienced urban buyers and accessible pricing.

● Audi Q3, BMW X1, and Mercedes GLA were the top premium models in Q2

● Metro repeat buyers lead this segment, often choosing upgrades over first-time ownership

● Tier 2 cities like Jaipur, Coimbatore, and Kochi outpaced metros with over 30% luxury segment growth

Q2 Highlights

● Akshaya Tritiya marked Spinny’s highest-ever single-day sales, with over 800 cars delivered.

● Net Promoter Score (NPS) reached a record 80 in June, reflecting strong buyer and seller satisfaction.

● Preference for cars under 3 years old rose steadily, peaking at 25% in June—driven in part by the Spinny Assured+ program offering a 3-year warranty.

○ April: 18%

○ May: 22%

○ June: 25%

Q3 2025 Outlook: Festive, Fast, and Financially Enabled

Looking ahead, Spinny expects:

● A surge in purchases during Onam and Diwali

● Continued growth in finance-enabled, digital-first journeys

● Deeper EV and hybrid interest, especially in tech-forward cities

● Stronger focus on women buyers, supported by tailored services and support models

“India’s car buyers today are more confident, better informed, and increasingly digital,” said Niraj Singh, CEO and founder of Spinny. “We see a diverse market coming together through trust and transparency. Spinny continues to enable this journey—city by city, car by car.”